Nov . 15, 2024 03:52 Back to list

hexagonal netting

The Concept of Hexagonal Netting in Finance

Hexagonal netting is an innovative financial strategy that aims to streamline the settlement of transactions among multiple parties, thereby enhancing efficiency and reducing counterparty risk. This approach, often utilized in the realm of derivative trading and financial exchanges, facilitates the reconciliation of trades, minimizes liquidity requirements, and mitigates operational risks involved in the settlement process.

At its core, hexagonal netting allows multiple counterparties to settle their obligations through a network of interconnections rather than through a series of one-to-one transactions. The term hexagonal refers to the geometric shape that represents the interconnected web of transactions in which each party can offset its liabilities with the assets owed to them by other parties in the network. This multi-party arrangement leads to a consolidated view of net obligations, thereby simplifying the entire settlement process.

One of the primary advantages of hexagonal netting is its potential to lower the total amount of cash that needs to change hands during the settlement process. By allowing parties to offset their transactions against each other, the overall cash requirement decreases. For instance, consider a scenario where Party A owes Party B $100, Party B owes Party C $70, and Party C owes Party A $30. Instead of each party settling their obligations in full, a hexagonal netting framework would allow these transactions to be netted down to minimize cash flows, thus saving time and resources.

Moreover, hexagonal netting enhances liquidity management for financial institutions

. Maintaining large amounts of liquid capital can strain institutional resources, and through effective netting arrangements, firms can reduce their liquidity requirements. This feature is particularly beneficial in volatile markets where maintaining a robust liquidity position is crucial for operational stability.hexagonal netting

Risk mitigation is another significant benefit of hexagonal netting. Financial institutions often face counterparty risk, i.e., the possibility that one party in a transaction may default on its obligations. By netting transactions, firms can reduce the potential loss associated with defaults, as the netting process helps consolidate exposures. Additionally, with fewer transactions to manage, firms can improve their monitoring and risk management capabilities.

Despite its benefits, hexagonal netting is not without challenges. The complexity of implementing a hexagonal netting framework can be daunting. It requires robust IT systems and excellent data management practices to ensure accurate calculations of net positions. Furthermore, all parties involved must have a clear understanding of the netting rules and settlement processes to avoid disputes or misunderstandings.

Regulatory considerations also play a crucial role in the adoption of hexagonal netting. Financial regulators often have stringent requirements regarding capital and liquidity, which can impact how netting arrangements are structured. As the financial landscape continues to evolve, it is essential for institutions to stay compliant with the changing regulatory framework while implementing these netting solutions.

In conclusion, hexagonal netting represents a progressive step in refining transaction settlements in the financial industry. By simplifying processes, reducing liquidity needs, and mitigating risks, it offers a compelling alternative to traditional settlement methods. As financial markets become increasingly interconnected and complex, the need for efficient mechanisms like hexagonal netting is more significant than ever. Institutions that can successfully implement such strategies stand to benefit immensely from improved operational efficiency, reduced costs, and enhanced risk management capabilities. However, careful consideration of the complexities and regulatory implications will be essential for a successful transition to this advanced netting technique. The future of finance may very well be influenced by how effectively these netting approaches can be integrated and adopted across the industry.

-

Why a Chain Link Fence is the Right Choice

NewsJul.09,2025

-

Upgrade Your Fencing with High-Quality Coated Chicken Wire

NewsJul.09,2025

-

The Power of Fence Post Spikes

NewsJul.09,2025

-

The Best Pet Enclosures for Every Need

NewsJul.09,2025

-

Secure Your Property with Premium Barbed Wire Solutions

NewsJul.09,2025

-

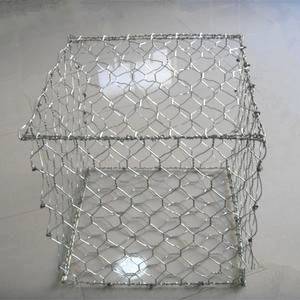

Enhance Your Construction Projects with Quality Gabion Boxes

NewsJul.09,2025

Products categories