Oct . 22, 2024 00:30 Back to list

Exploring the Benefits of Hexagonal Netting in Financial Settlements and Risk Management

Hexagonal Netting A Comprehensive Overview

Hexagonal netting, often referred to as honeycomb netting, represents an innovative approach to financial settlements and risk management in the world of finance. This concept has gained traction as institutions seek more efficient ways to settle interbank transactions, reduce credit risk, and improve liquidity management. By exploring the principles and applications of hexagonal netting, we can understand its significance in today's financial landscape.

At its core, hexagonal netting involves the consolidation of multiple cash flows between parties into a single net amount for each participant, allowing for more efficient settlement. Traditional netting methods often suffer from limitations in liquidity and complexity due to the sheer volume of transactions that need to be settled. Hexagonal netting addresses these issues by employing a geometric approach, where transaction obligations are represented in a hexagonal structure.

The hexagonal structure aids in visualizing the relationships between different parties and their transactions, making it clearer for institutions to see which obligations offset each other. This visualization reduces the number of settlements needed, ultimately streamlining the process and minimizing the associated costs. The hexagonal model allows for an optimized settlement process, as it emphasizes the interconnectedness of transactions and facilitates a more holistic view of financial obligations.

In practice, the implementation of hexagonal netting can lead to significant benefits for financial institutions, especially in reducing counterparty risk

. By netting transactions, institutions minimize the outstanding amounts that any one party owes to another, thereby limiting potential exposure to defaults. This is particularly relevant in times of financial uncertainty, where the stability of counterparties can be called into question. The reduced risk of default is complemented by improved liquidity, as parties are required to settle only the net amounts rather than the gross amounts, freeing up capital for other investments.hexagonal netting

Moreover, hexagonal netting can enhance operational efficiency. Traditionally, firms expend substantial resources on transaction processing and reconciliation. The adoption of a hexagonal netting system replaces multiple transactions with a single settlement, which can decrease the workload on back-office operations and cut costs associated with transaction processing. This shift not only saves time but also enables institutions to allocate resources more effectively.

Critically, the success of hexagonal netting relies on robust technological infrastructure. Advanced software solutions and real-time data analytics are essential for effectively managing the complex relationships that characterize a hexagonal netting framework. As financial markets evolve and transactions become increasingly intricate, the need for enhanced technology to support netting processes will only grow. Consequently, investing in the right technology is fundamental for institutions wishing to leverage the advantages of hexagonal netting.

Furthermore, hexagonal netting can also play a significant role in regulatory compliance. With mounting regulatory scrutiny surrounding transparency and risk management, institutions must demonstrate effective strategies for monitoring and mitigating risk. By implementing a hexagonal netting framework, financial institutions can provide regulators with clearer insights into their risk exposures and settlement practices. This clarity can foster a more collaborative relationship with regulators and support broader financial stability.

In conclusion, hexagonal netting represents a forward-thinking approach to managing financial transactions that addresses the challenges of efficiency, risk, and regulatory compliance. By enabling institutions to visualize and streamline their obligations, hexagonal netting fosters a more robust financial ecosystem. As financial markets continue to evolve, the implementation of such innovative frameworks will be crucial for institutions aiming to thrive in an increasingly complex landscape. In embracing hexagonal netting, financial institutions are not just optimizing their operations; they are also paving the way for a more secure and resilient financial future.

-

Why a Chain Link Fence is the Right Choice

NewsJul.09,2025

-

Upgrade Your Fencing with High-Quality Coated Chicken Wire

NewsJul.09,2025

-

The Power of Fence Post Spikes

NewsJul.09,2025

-

The Best Pet Enclosures for Every Need

NewsJul.09,2025

-

Secure Your Property with Premium Barbed Wire Solutions

NewsJul.09,2025

-

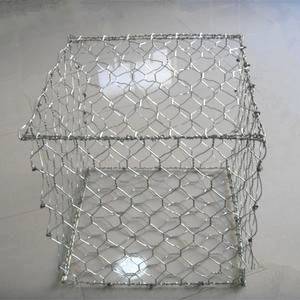

Enhance Your Construction Projects with Quality Gabion Boxes

NewsJul.09,2025

Products categories